Negros Occidental 3rd District Rep. Francisco “Kiko” Benitez lauded the private education advocates for the passage of Republic Act No. 11635 that, he said, “provides for a clearer tax regime for private schools.”

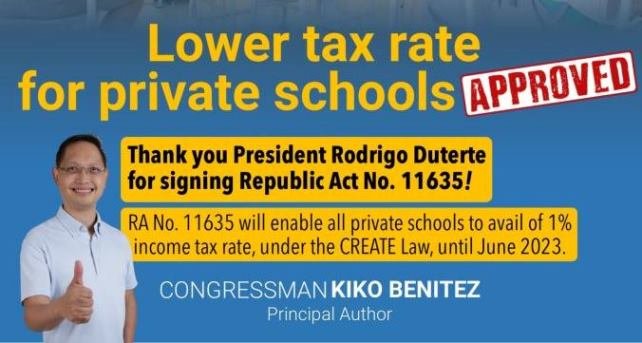

Benitez, principal author of the law signed by President Rodrigo Duterte recently, said that private schools can now avail of lower tax rate under the CREATE, or Corporate Recovery and Tax Incentives for Enterprises Act.

“This will reduce operational costs during the challenging times, and hopefully provide fiscal space for new investments to transition to digital learning,” he said on a Facebook post.

The solon also thanked Duterte for signing the law that, he said, will enable all private schools to avail of one percent income tax rate, under the CREATE Law, until June 2023.

RA 11635 amends Section 27 of the National Internal Revenue Code of 1997, which states that hospitals, which are nonprofit, and proprietary educational institutions, shall pay a tax of 10 percent on their taxable income, except those covered by subsection D. Beginning July 1, 2020 until June 30, 2023, the tax rate imposed shall be one percent.

“If the gross income from unrelated trade, business or other activity exceeds 50 percent of the total gross income derived by such educational institutions or hospitals from all sources, the tax prescribed…shall be imposed on the entire taxable income,” the law added.

Proprietary educational institution means any private school maintained and administered by private individuals or groups with an issued permit to operate from the Department of Education, Commission on Higher Education, or the Technical Education and Skills Development Authority. | NND