• CHERYL G. CRUZ

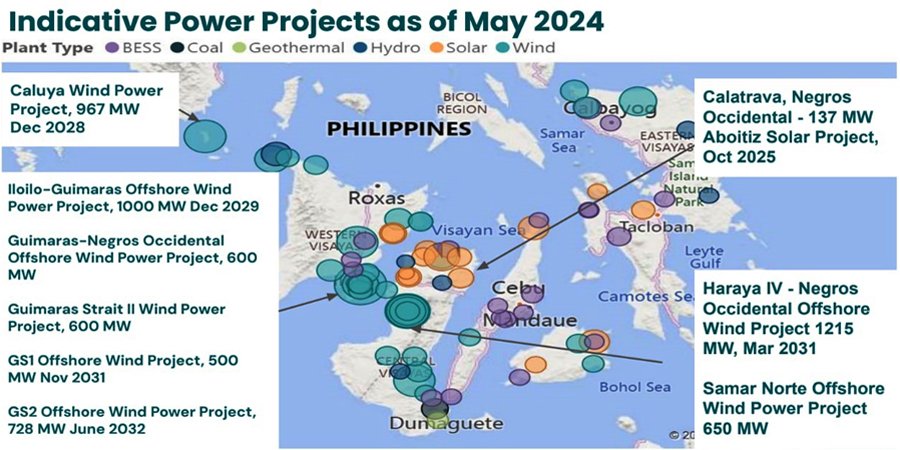

Two renewable energy (RE) projects in Bacolod City, and five in Negros Island, are among the more than 15 indicative plants in the Visayas for 2024 and 2025, as the Department of Energy intensifies its push to transition to a “more clean, affordable, and secure energy system”.

These indicative projects, or those still in the planning stage, include the 130-megawatt (MW) proposed solar plant of Negros PH Solar Inc. in Bacolod City and nearby Brgy. Tabunan in Bago City, as well as the 41MW solar plant of Amatera Renewable Energy Corp., also in Bacolod, in 2025, Jephraim Manansala, chief data scientist of the Institute for Climate and Sustainable Cities (ICSC), said Sept. 20.

The Energy Development Corp. is also eyeing to put up a 40MW geothermal plant in Dauin, while the Phinma Energy Corp. and Megawatt Solutions Inc. have a 21MW and 40MW hydro and BESS (Battery Energy Storage System) indicative projects, respectively, in Mabinay and Amlan, both in Negros Oriental, in 2025.

The EDC also has a 5.65MW geothermal project in Brgy. Mailum, Bago City, and a 30MW BESS plant in Valencia, Negros Oriental this year, out of the 25 committed power plants in the Visayas, with total potential capacity of 1,982MW, Manansala said.

“Committed plants are those already in the construction phase or have financial close in place, based on the DOE list, as of June this year,” he explained at the “Media Training on the Philippines’ Energy Transition”, Sept. 20-21 in Bacolod City.

Of the committed projects, 38.37 percent are solar, 26.01 percent wind, and 15.64 percent BESS as the DOE’s National Renewable Energy Program (NREP) for 2020-2040 targets a 35 percent share of RE in the power generation mix by 2030, and aspires to increase it further to 50 percent by 2040, Manansala said.

John Christian Porte, science research specialist at the DOE’s Renewable Energy Management Bureau (REMB), said that since the effectivity of Republic Act No. 9513, or the RE Law in 2009, there were 2,707MW additional RE capacity installed in the country, with P279.5 billion worth of investments, and 357,248 green jobs created in 2022.

RAPID COAL DEVELOPMENT DESPITE RE LAW

Manansala said that when the RE Act was enacted in 2008, the renewable energy share was at 35 percent, with 18 percent geothermal and 16 percent hydroelectric.

But it decreased to 21 percent, as of 2022, as there was “rapid development of coal in the past decade, overtaking the growth of RE power plants,” he added.

In Negros, the DOE said 709MW of dependable capacity can be found in the island, with solar and geothermal energy making up a “large chunk, with 65 percent local energy generation”.

Ground mounted (solar) plants comprise 34 percent of the existing RE facilities in Negros, with dependable capacity of 244MW. Geothermal contributes 220MW (31 percent), and biomass at 183MW, or 25 percent.

RE-RICH, COAL-DEPENDENT

Despite the tag as the clean energy capital of the Philippines, with installed and committed RE plants, and the existing ban on coal-fired projects, Negros distribution utilities (DUs) rely heavily on coal in their purchase of electricity from the Wholesale Electricity Spot Market (WSEM), and their power supply agreements (PSAs) with generation companies (gencos) or independent power producers (IPPs).

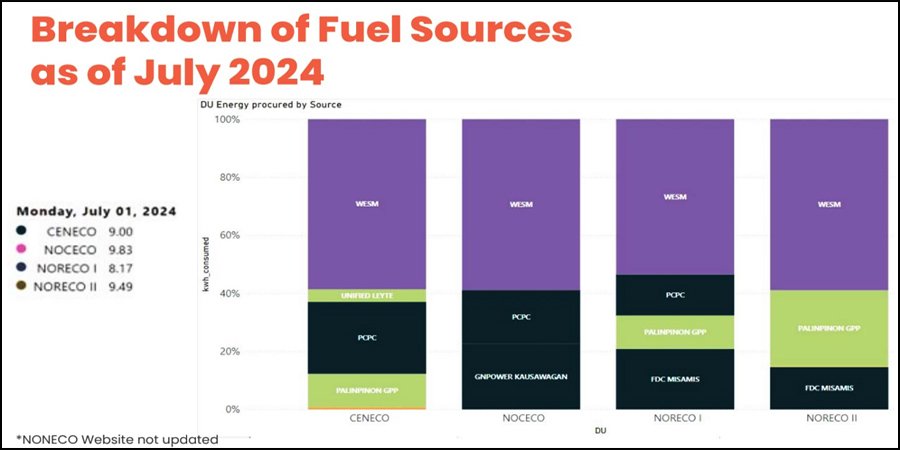

Based on consumption per fuel type in 2023, the Central Negros Electric Cooperative logged 60.24 percent coal, 30.34 percent WSEM, and 5.9 percent geothermal purchase mix.

The Northern Negros Electric Cooperative procured 77.5 percent coal, and 19.66 percent from WSEM; while the Negros Occidental Electric Cooperative had a 51.48 percent WSEM and 48.52 percent coal procurement mix.

As of July 2024, energy procured by source showed that Ceneco was still highly dependent on WSEM for its power needs, and from PCPC (Palm Concepcion Power Corp.), which operates a coal-fired power plant in Iloilo; while Noceco got its electricity from the spot market as well as from its PSAs with PCPC and GNPower Kauswagan.

“Coal is expensive and volatile. Prices of the Newcastle coal, which is the benchmark price for coal in the Asia-Pacific have been heavily impacted by the pandemic and the global energy crisis,” Manansala said.

PASALOAD

He also noted a clause in the contracts between the power plants and DUs “where the generation charge can change based on the price of fuel used by IPPs. This enables the volatility of the world markets to be reflected in the local electricity pricing conditions.”

The automatic fuel pass through or pasaload means that power producers have minimal risk investments, “placing the burden of fossil price volatility on the consumers.”

“This is considered highly-disadvantageous to consumers because they bear all fuel risks while being the least capable of mitigating such risks,” Manansala said, adding there is “longstanding call to abolish and discontinue this pasaload clause to ensure a competitive electricity market.”

RENEWABLE PORTFOLIO STANDARDS

Gaspar Escobar Jr., ICSC grid modernization advisor, said consumers and the media should be aware of the PSAs that their DUs enter into with IPPs, as well as the power supply procurement plan (PSPP) of each electric cooperative.

Escobar, who was chief of the Technical Services and Management Division of the DOE’s Renewable Energy Management Bureau before he retired, said that under the RE Law, all DUs are required to source a specified portion of their electricity needs from eligible RE facilities, which could result in lower bills for power consumers.

The minimum annual RE percentage increment is now at 2.5 percent from one percent when the RE Law was newly-passed, he said, adding there is corresponding penalty for violation.

Consumers and local governments should be aware of this, and should check if their DUs are compliant to the RE Law’s renewable portfolio standards, Escobar said at the training organized by ICSC and the German government international aid agency Deutsche Gesellschlaft für Internationale Zusammenarbeit (GIZ) GmbH.

The organizers said that media’s proactive involvement in reporting the urgent need to accelerate the energy transition is pivotal in raising awareness, promoting transparency, and increasing accountability among stakeholders.

“The mission (is) to shift the narrative surrounding the current energy landscape and push for a more clean, affordable, and secure energy system in the country,” they added. | CGC